Tesla stock jumps 20% in one day on Panasonic’s earnings

https://ift.tt/2v2qfyS

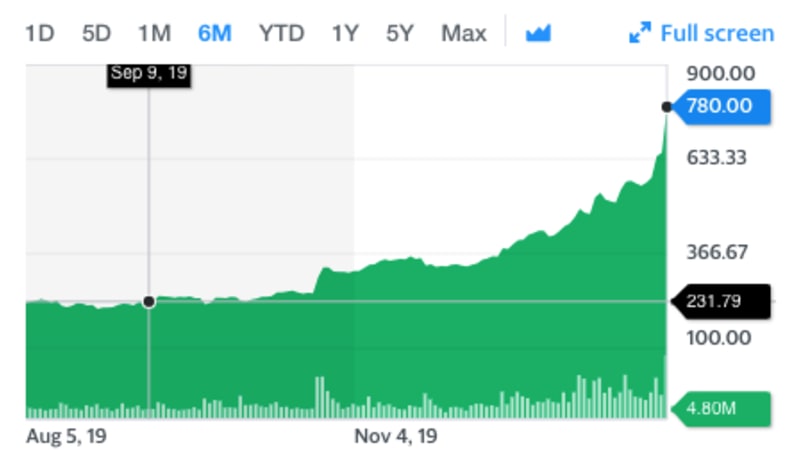

TOKYO/SAN FRANCISCO — Tesla’s stock surged 20% on Monday in its largest one-day gain since 2013, fueled by a quarterly profit at Panasonic’s battery business, with the U.S. car maker and an investor report predicting its shares would rise more than ten-fold by 2024.

Shares of Tesla have rallied by over 30% since the car maker run by Chief Executive Elon Musk posted its second consecutive quarterly profit last Wednesday, which was viewed as a milestone for the company competing against established heavyweights including General Motors Co and BMW.

The stock is up over 300% since early June, helped by Tesla’s better-than-expected financial results and ramped up production at its new car factory in Shanghai.

Monday’s rise came after Panasonic Corp reported the first quarterly profit in its U.S. battery business with Tesla, which followed years of production troubles and delays.

“We are catching up as Tesla is quickly expanding production,” Panasonic Chief Financial Officer Hirokazu Umeda told an earnings briefing, referring to battery cell production.

“Higher production volume is helping to push down materials costs and erase losses.”

Musk last April said that battery production had become a constraint on output of Tesla’s Model 3 sedans.

Adding to jubilance around Tesla, investment management firm Ark Invest, in a note dated Jan. 31, said it expects the company’s stock to hit $7,000 by 2024, compared to Monday’s record high of $780. It based that prediction, which would put the company’s market capitalization at $1.3 trillion, in part on Tesla launching a fleet of profitable “robotaxi” autonomous cars.

Musk told investors last April that robotaxis with no human drivers would be available in some U.S. markets in 2020, a claim met with skepticism by experts who said the company’s technology was nowhere near ready.

Tesla is Wall Street’s most shorted stock, and its recent rally has pummeled traders betting against it. Short sellers on Monday suffered paper losses of over $2.5 billion, bringing their losses in 2020 to more than $8 billion, according to S3 Partners, a financial analytics firm.

Panasonic first invested in Tesla in 2010 and announced its partnership in building the U.S. firm’s Gigafactory plant in Nevada in 2014 as part of its strategic shift from low-margin consumer electronics to automotive components.

But as its $1.6 billion Gigafactory investment failed to produce solid returns, Panasonic has grown cautious about its battery business with Tesla.

It chose not to build a new battery plant for Tesla in China, ceding its battery cell monogamy as Tesla entered into a partnership with South Korea’s LG Chem Ltd and China’s CATL.

“We will focus on demand at Gigafactory for Model 3 and Model Y,” Umeda said.

Panasonic is turning to Toyota Motor Corp for battery partnership, setting up a joint venture for electric vehicle (EV) batteries in April.

Panasonic said operating profit for the October-December quarter rose 3% to 100.4 billion yen ($915 million), beating analysts’ estimates by 49%, thanks to the improvement at the Tesla battery business as well as cost cuts.

It maintained its profit forecast for the year through March at 300 billion yen, above an average estimate of 295.14 billion yen by 20 analysts.

Auto Blog

via Autoblog https://ift.tt/1afPJWx

February 3, 2020 at 06:47PM